We are a Joint Venture between two formidable institutions with in-depth understanding of proven track record of thought leadership in startup ecosystem; and understanding of wealth management and private banking.

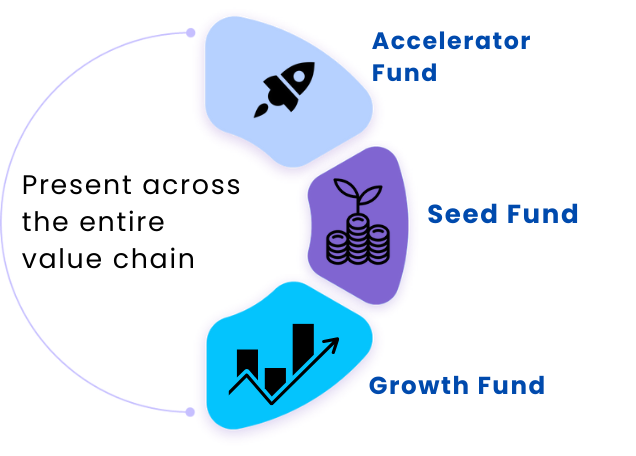

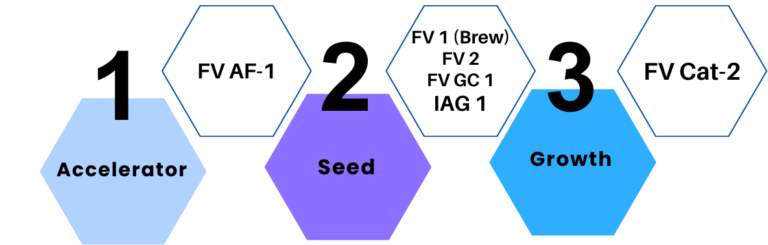

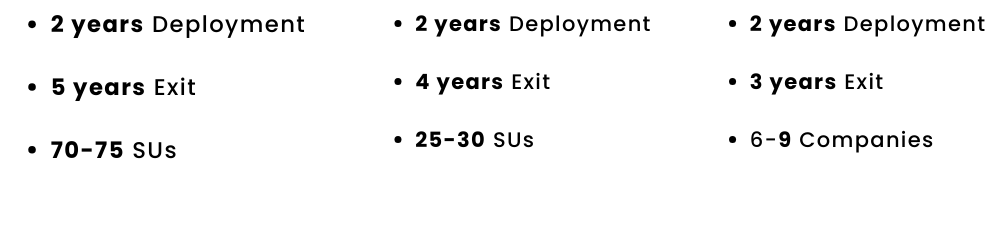

A Multi-Stage Fund across entire value stream.

The leading MICRO-VC

Judicious mix of Top-down thesis driven & Bottoms-up value investing approach

Our Numbers

0

Startups Invested so far

₹

0

+ CR

Committed Capital

4 (CAT I & II) AIFs Funds

1 (IFSC) Gift City Fund

The Founding Team

Our Investment Ethos

Strategic Wealth Management

Long-term wealth creation remains our utmost priority. We focus on strategic investments that align with our clients’ financial goals, ensuring sustainable growth and robust returns.

Empowering Startups

We back ambitious and game-changing startups, providing them with the resources, mentorship and other resources needed to thrive in a fiercely competitive market.

Positive Economic Impact

Our investment strategy is clear – focus on projects that generate significant returns, boost community development, and overall economic growth on a macro level.

The Finvolve Advantage

Our main goal is wealth creation.

01.

Tailored Deal Flow

02.

Masterclasses to Master Your Investment

03.

Navigating Legalities with Ease

04.

Supporting Your Success Post-Investment

Know Our Process

By leveraging shared insights and resources, participants enhance their services, access new markets, and drive growth. Together, we set new standards in wealth management, achieving greater success through collaboration and collective expertise.

Onboarding

Our client onboarding process is centred around multiple steps - product selection, carrying out checks, regulatory compliance, and more. With automation, our process is simplified - not chaotic for everyone involved.

Introduction

We spend time in understanding the thesis and expectation mapping to know more about your goals, success metrics, strategies and prerequisites that you expect from us.

Deal Flow

In the wake of getting the cream of startups for your investment, our team extends a deal flow of curated startups.

Pitches

Post our detailed vetting process, we focus on startup pitches and sensing the gravity of the matter, the pitch ought to be a winner one, which could help them win the investors straightaway.